Ever since, budgeting and managing finances is not my forte. I want to invest my money but I don't know where to begin. I'm really glad that the #SoMoms have sessions like this, we get to learn and educate ourselves about different investments, how to save for our children's future and more. It's really a road to a #BetterMe.

But first, our venue for the session was at The Gallery 1 of New World Makati. It's a small function room with a private kitchen! I was floored! It's my first time to see a function room like this. I feel so sosyal. Hihi!

See the oven on the left side? Fresh bread is being baked!

The blueberry muffin is yummy!

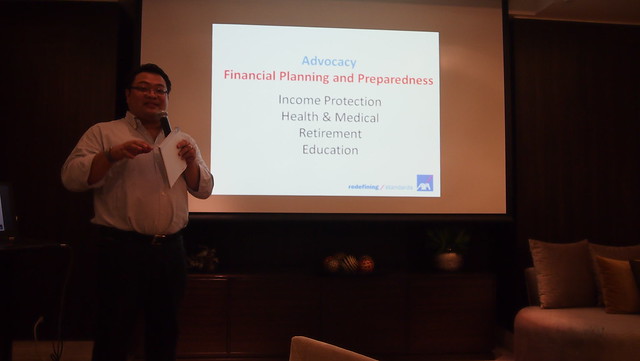

To start our talk, Dandee Adapon of AXA gave a brief background about the company and why is it necessary to have a financial plan and being prepared.

And to talk to us more about money matters is Rose Fres Fausto.

Mary Rose Fres Fausto graduated with honors from the Ateneo de Manila University in 1985, with a degree in A.B. Economics. She was an investment banker before she decided to be a full-time homemaker. She is married to Marvin, a fund manager, and they have three sons Marty, Enrique and Anton. She believes that raising their children well is the greatest contribution parents can give to the country and the best service they can offer to God.(Taken from her blog)

I was very kuripot during my school days. I would always keep my allowance so I can save. I like seeing my savings add up. My parents started us early, teaching us how to save and all. But well, what I wasn't prepared for was the expenses and money matters when I got married and had kids. I'm really scared that I won't have enough money for my kids' education!

Money matters should be a family affair. In some families, speaking of money is considered to be not proper. But I think it's better to face reality rather than ignore it. That is why I've always been honest about our money matters to my husband.

I learned a lot from Rose's talk. And I hope I can do it and teach my kids on how to save and invest. Some of my things I've picked up from the talk: FQ - Financial Intelligence Quotient Didn't know there's such thing! Having a high FQ is your economic self defense! I want my kids to have high FQ! Kids nowadays have so much spending power, it really is the new generation. While I'm a bit scared, I want my children to be capable on managing their money.

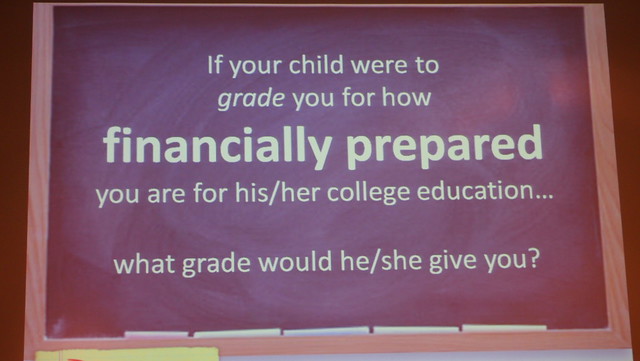

Planning your financial future should involve your child. I never knew this. It's never too late to start teaching your kids about money, if not, start them young! Rose's kids invested their money in stocks. She and her husband taught their kids early, and I must say WOW. I must learn not to be scared of investing in stocks. Seeing how successful Rose and her husband with raising children to be money-wise, I want my kids to be the same.

I grew up having my own "kiddie" account. I remember my passbook has a Kangaroo cartoon. If I remember it right, it was from City Trust! And I also did the same for my kids. Yukie started her piggy bank (more like Robot bank) just this June. We told her that it will be her money to buy a new Barbie doll ( I don't know if that's a proper way of teaching), and she would always ask for our coins and put it in her piggy bank. But other than that, I opened a bank account for each of them when they turned 1. All of their ang paos from birthdays and Christmases, I deposit them to their respective accounts. And every time I have extra money, I also deposit to each of their account.

Got an emergency funds? Retirement savings? We need start to save for our retirement! My first thought was: What retirement? That's like years and years from now! We think that this is so far away that we delay saving for our retirement. This should be one of the first things to save for. I don't want to burden my kids of having to provide for me or ask money from them. They will also have their families in the future and that would be their priority.

Got extra funds? Invest them. There are so many kinds of investment nowadays, there are short term and long term investments. Choose what your comfortable investing your money into. Learn how they work and not just put your money where interest is high.

I'm so glad to have attended this talk. BOS and I need to talk pa about investments but I've certainly learned a lot! Thank you again #Somoms!

Of course, I would also like to thank New World Makati for serving us breakfast and lunch!

AXA is having an ongoing promo! You can win a trip to Lego Land in Malaysia! Just sign up here!

I learned a lot from Rose's talk. And I hope I can do it and teach my kids on how to save and invest. Some of my things I've picked up from the talk: FQ - Financial Intelligence Quotient Didn't know there's such thing! Having a high FQ is your economic self defense! I want my kids to have high FQ! Kids nowadays have so much spending power, it really is the new generation. While I'm a bit scared, I want my children to be capable on managing their money.

Planning your financial future should involve your child. I never knew this. It's never too late to start teaching your kids about money, if not, start them young! Rose's kids invested their money in stocks. She and her husband taught their kids early, and I must say WOW. I must learn not to be scared of investing in stocks. Seeing how successful Rose and her husband with raising children to be money-wise, I want my kids to be the same.

I grew up having my own "kiddie" account. I remember my passbook has a Kangaroo cartoon. If I remember it right, it was from City Trust! And I also did the same for my kids. Yukie started her piggy bank (more like Robot bank) just this June. We told her that it will be her money to buy a new Barbie doll ( I don't know if that's a proper way of teaching), and she would always ask for our coins and put it in her piggy bank. But other than that, I opened a bank account for each of them when they turned 1. All of their ang paos from birthdays and Christmases, I deposit them to their respective accounts. And every time I have extra money, I also deposit to each of their account.

Got an emergency funds? Retirement savings? We need start to save for our retirement! My first thought was: What retirement? That's like years and years from now! We think that this is so far away that we delay saving for our retirement. This should be one of the first things to save for. I don't want to burden my kids of having to provide for me or ask money from them. They will also have their families in the future and that would be their priority.

Got extra funds? Invest them. There are so many kinds of investment nowadays, there are short term and long term investments. Choose what your comfortable investing your money into. Learn how they work and not just put your money where interest is high.

I'm so glad to have attended this talk. BOS and I need to talk pa about investments but I've certainly learned a lot! Thank you again #Somoms!

Of course, I would also like to thank New World Makati for serving us breakfast and lunch!

AXA is having an ongoing promo! You can win a trip to Lego Land in Malaysia! Just sign up here!

No comments :

Post a Comment